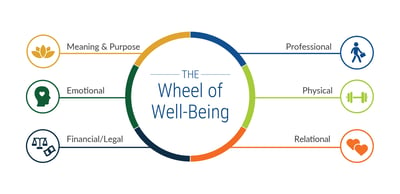

The VITAL WorkLife Wheel of Well-Being is a tool used to evaluate distinct areas of life and build overall well being through improving each dimension of well-being. Your overall well-being is made of multiple dimensions. Financial Well-Being is one of the dimensions contributing to your holistic health; you cannot achieve overall well-being without having balance in each of the dimensions.

The VITAL WorkLife Wheel of Well-Being is a tool used to evaluate distinct areas of life and build overall well being through improving each dimension of well-being. Your overall well-being is made of multiple dimensions. Financial Well-Being is one of the dimensions contributing to your holistic health; you cannot achieve overall well-being without having balance in each of the dimensions.

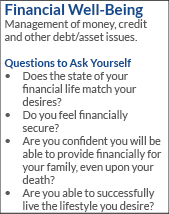

Financial Well-Being

A useful definition is offered by the federal government’s Consumer Financial Protection Bureau based on their survey of US consumers to learn what Financial Well-Being means to them. They found four major elements:

- Feeling in control of finances on a day-to-day and month-to-month basis

- Capacity to absorb a financial shock from such events as a layoff or temporary disability

- Being on track to meet financial goals (e.g. moving toward financial freedom)

- Affording activities to enhance enjoyment of life, such as working less to be with family, eating out, vacations.

At VITAL WorkLife, we define Financial Well-Being as:

"Having acumen, stability and a sense of security related to the management of money, credit, debt and assets."

What Contributes to Financial Well-Being?

What Contributes to Financial Well-Being?

Many factors contribute to Financial Well-Being, including such tasks as building adequate savings, planning for retirement, preparing for a child’s education, preparing necessary legal documents such as wills and trusts, having adequate insurances (such as life, medical, disability, homeowners or long-term care) and levels of coverage, protection from personal or professional liability, and home buying. As you can see, there are many areas available to you to work on if you are interested in improving your Financial Well-Being.

Case Study

John and Stephanie had become overwhelmed with debt, incurring over $30,000 on credit cards plus owing on two cars and a student loan. They had been “sort of” aware of the increasing debt over the past few years but never added it all up. Having had the ability to “make payments” led to the belief they were handling things. Now, making minimum payments was difficult.

After summoning the courage to sit down with all the bills, they were shocked to see their overall debt was close to $100,000. Their hopes of buying a home and starting a family faded fast. Unsure of whether they would be able to get out from under the debt, fears of bankruptcy were added to their already significant stress. The worry was keeping them up nights.

The couple could have played the “rob Peter to pay Paul” strategy for some time yet, but chose to consult with a financial counselor to deal with the problem. John and Stephanie were relieved to learn they could deal with the debt. The counselor assisted with a debt management plan and budget.

These were not easy to implement but seeing progress helped build their determination and lifted their spirits. Initial tracking of spending had revealed they were minus $1,200 each month. By not paying attention to their spending, they had no idea how much more debt they were adding each month. The couple learned more about personal finance and started planning for a home and family. Another benefit was realizing they enjoyed financial peace more than they missed fancy cars, clothes and dining out; in fact, they really didn’t miss those things much at all.

How to Achieve and Maintain Financial Well-Being?

In addition to the specific problems associated with financial or legal stress, these issues may cause or worsen physical, relational, emotional and general mental health problems. A willingness to take an honest look at these issues along with a desire to make positive changes is the first step. Achieving and maintaining financial/legal well-being can be accomplished by increasing awareness and knowledge, seeking appropriate supports and professional guidance, and cultivating a desire and intention to make improvements. In the case of money, find out what your relationship is to it, i.e., it represents safety, comfort, success, love, or power; you spend compulsively to boost your mood.

To learn more about your Financial Well-Being dimension, you can read from our recommended reading list.

We Can Help

VITAL WorkLife supports all dimensions of your Wheel of Well-Being. Call us anytime, day or night, for support for your Financial Well-Being. Access additional resources to enhance your financial well-being by logging into the Member Website.

- Employee Assistance Program (EAP) members call 800.383.1908 or access resources through your VITAL WorkLife App

- Physician/Provider Well-Being Resources members call 877.731.3949 or access resources through your VITAL WorkLife App

Check out our video below to learn more about the Wheel of Well-Being:

Source:

Consumer Financial Protection Bureau, 1700 G Street, NW, Washington, D.C. 20552, 202-435-7000 http://www.consumerfinance.gov