With the population aging, it is important to keep up with financial information impacting your retirement. Planning ahead is a good approach toward financial health and therefore, overall well being. See VITAL WorkLife's Wheel of Well Being. Social security plays a big role in your financial health as you reach retirement age.

Why Social Security?

President Franklin Roosevelt signed the Social Security Act on August 14, 1935. Life expectancy then was 61.7 years. It was intended to provide “some measure of protection” against poverty in old age. However, times are changing. According to the Social Security Administration planning ahead is more important than before,“…because we're living longer, healthier lives, we can expect to spend more time in retirement than our parents and grandparents did.”

How Much Does Social Security Cost?

Workers pay 6.2% of their wages to Social Security Tax and 1.45% to Medicare Tax. In addition your employer pays the same percentages for you, meaning, that if you are self-employed you pay a total of 15.3%. Medicare tax is higher if your income is over $200,000 or $250,000 and married filing jointly. You do not pay Social Security Tax on earnings above $118,500.

How Much Do I Benefit from Social Security?

The amount of monthly social security benefit is based on the average of your highest 35 years of earnings. The maximum monthly benefit available is $2,639. This would be the case if an individual starts collecting Social Security at full retirement age today (66 years old) and made the maximum of $118,500 (or inflation adjusted equivalent) for the 35 years. The average monthly benefit paid out is $1,350, which totals around $16,000.

When Can I Start My Social Security Benefit?

The earliest you can take social security is 62. Full retirement benefits were available at age 65 for many years but changed to 66 if you were born between 1943 – 1954. This gradually rises to 67 for those born 1955 - 1959. Those born in 1960 or later have full benefits at 67. If your full retirement age is 67, your Social Security benefit is reduced by:

- About 30 percent if you start collecting at 62

- About 25 percent if you start collecting at 63

- About 20 percent if you start collecting at 64

- About 13.3 percent if you start collecting at 65

- About 6.7 percent if you start collecting at 66

Full benefit if you start at 67:

Benefits continue to increase every year you wait to start collecting until you reach 70, with the monthly benefit being about 24% higher than at full retirement age.

*For one third of recipients, Social Security comprises over 90% of their income. Over 40% of all recipients would be in poverty without it. 61% rely on Social Security to provide at least half of their income.

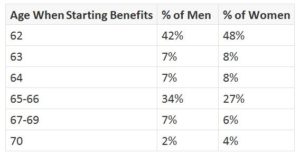

*The most common age to start collecting benefits is 62; the earliest possible age (42% of men, 48% of women). Many financial planners advise individuals to wait until age 70 to claim benefits in order to maximize them. As you can see by the chart below, very few actually do this.

When Do Americans Start Collecting Social Security?

By age and gender, here's when Americans begin collecting Social Security:

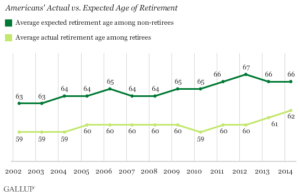

According to Gallup, the average retirement age is now 62. This is a new development. Until the past few years, the average age of retirement vacillated between 59 and 60. In the 1990’s it was around 57. As you can see in this chart, on average, people retire much sooner than they plan. A good portion of individuals are forced to retire earlier than planned due to health reasons, layoffs or having to care for a loved one.

Source: Center for Retirement Research

Source: Gallup

Where Can I get a Social Security Statement?

To get your Social Security benefit statement, CLICK HERE.

We Can Help

If you or a family member finds themselves in a financial crisis, call VITAL WorkLife for a free consultation with a financial consultant. If you are a member of one of our solutions, contact us any time, day or night, at 800.383.1908 or through the VITAL WorkLife App for the support you and your family need.

For more information about our comprehensive suite of well being solutions, call 800.383.1908 or contact us online.